Your Brand, Your Colors

Acquire

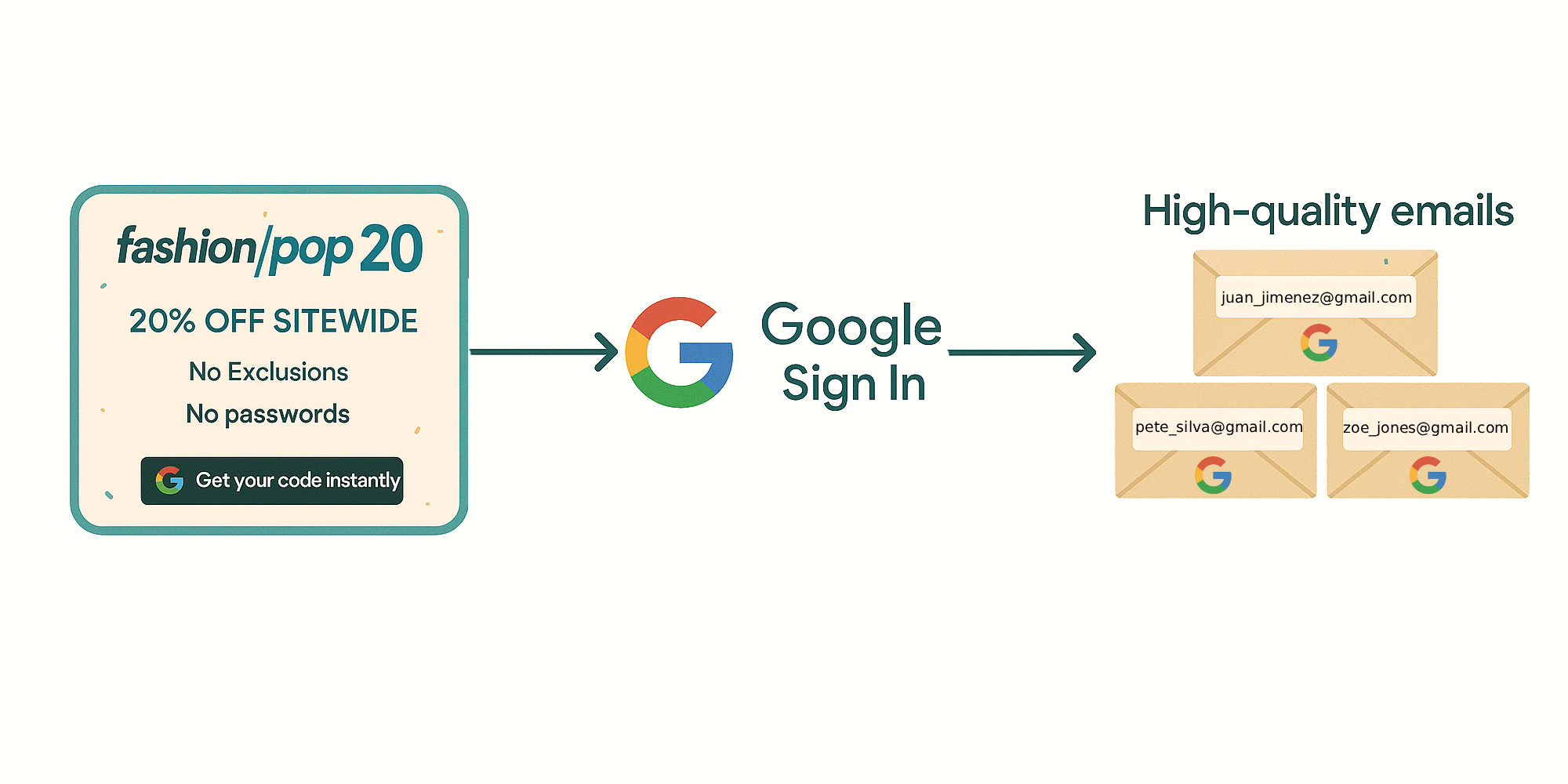

FashionPop uses Google-verified sign-in to capture customers' best emails and turn more visits into conversions. Sell

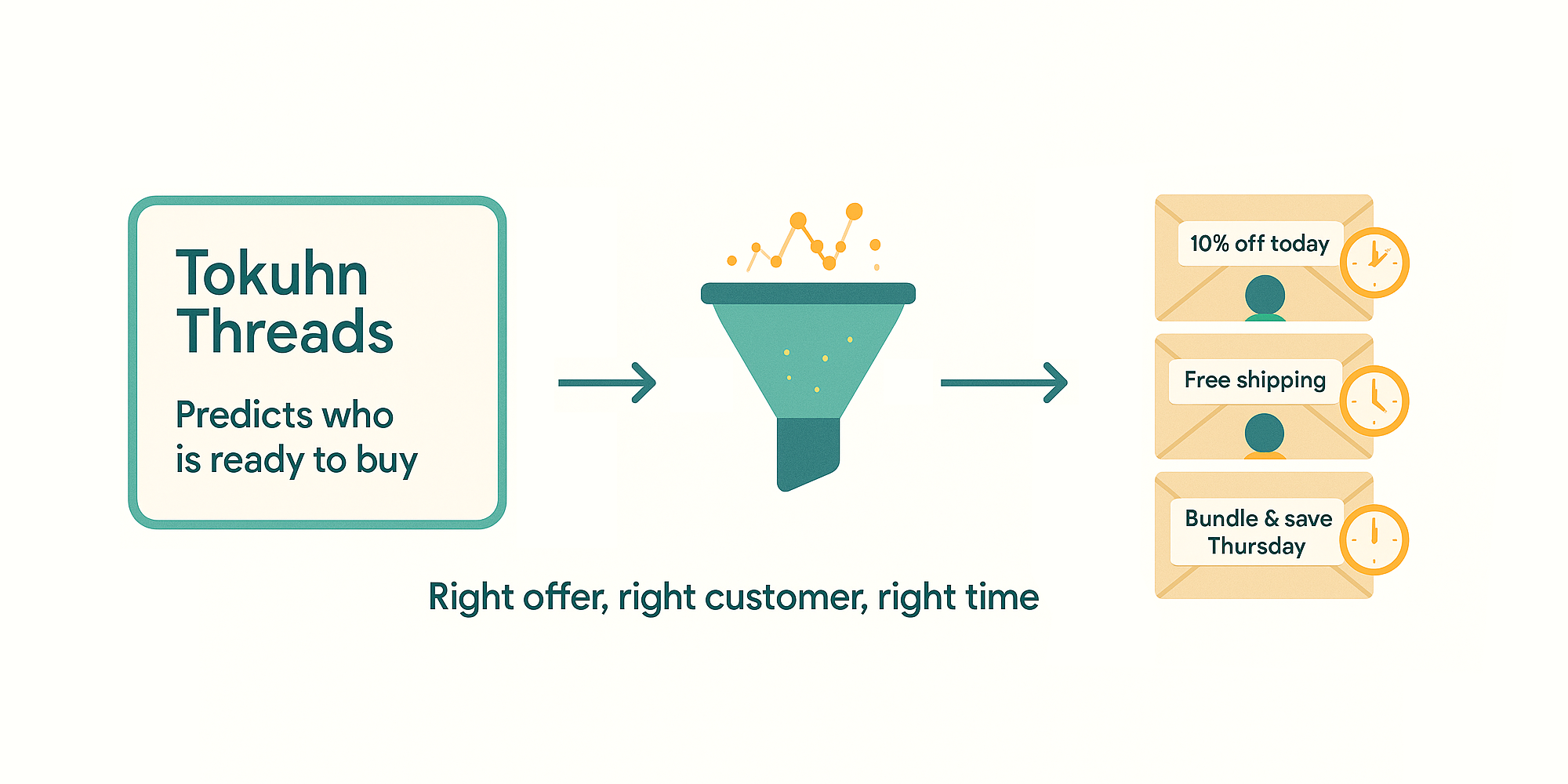

Tokuhn Threads predicts who is ready to buy, so you can send the right offer to the right customer at the right time. Grow

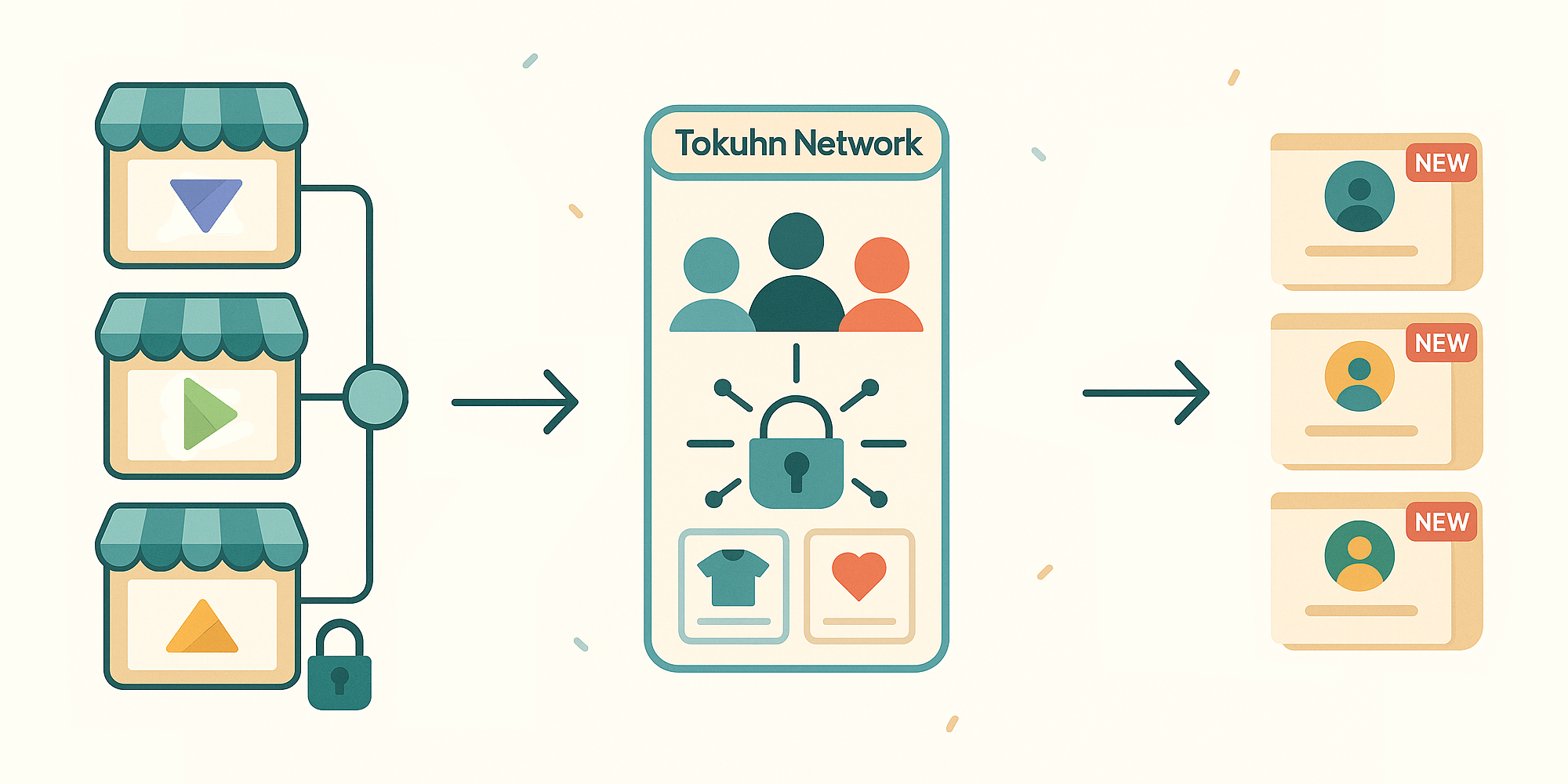

Reach new buyers through Tokuhn Network. You pay only when you gain a new customer, and you keep the data. Thrive

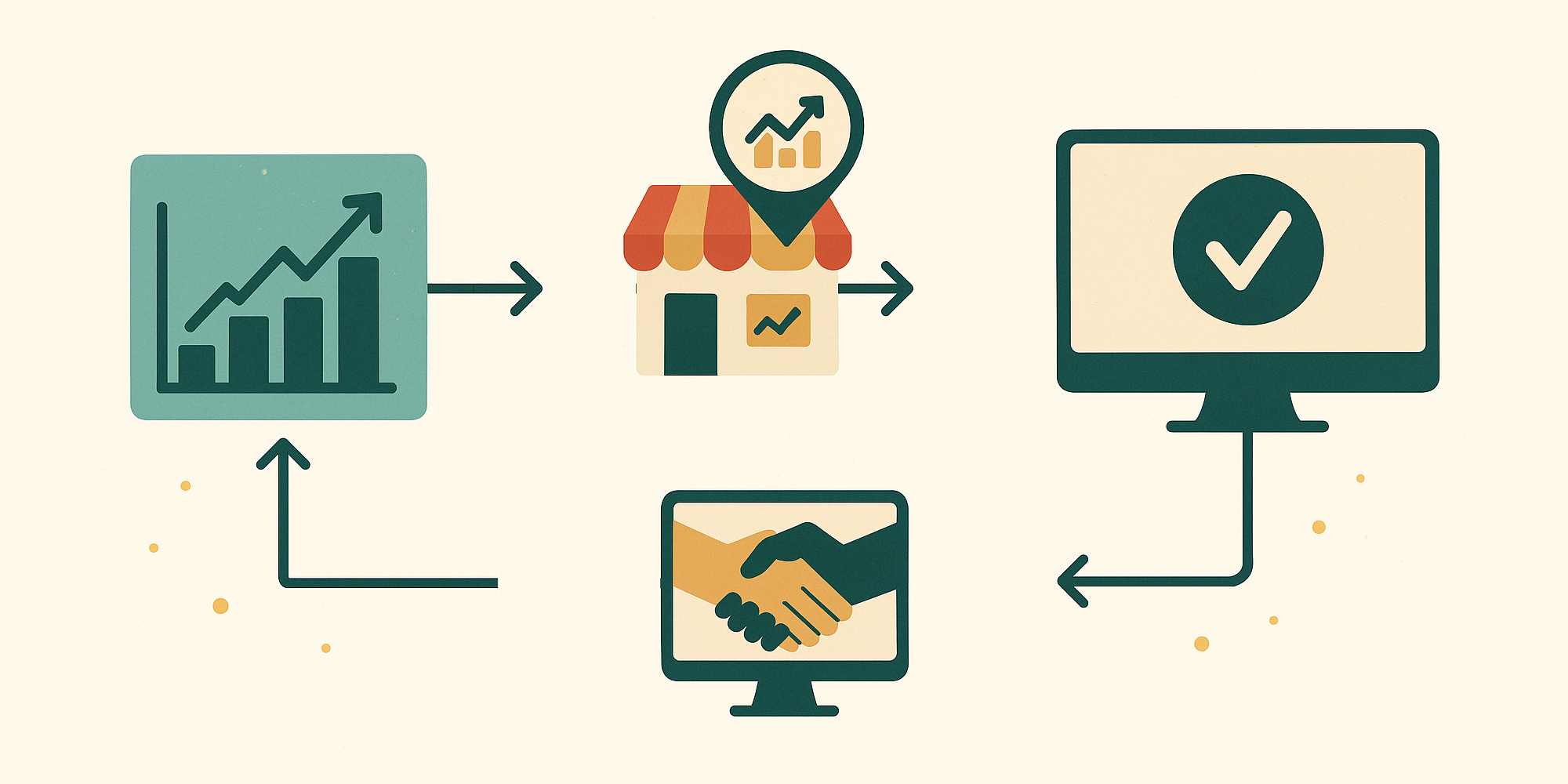

Tools and insights powered by Tokuhn 2400 benchmarks, in-house research, as well as Coalesce® and Precipitate® to turn signals into better results for merchants. Acquire

Sell

Grow

Thrive

Build

# Acquire

Get Leads You Can Actually Convert #

"Am I effectively acquiring leads, or am I just lighting margin on fire?"

The cards in this section answer that question. You'll see calculators, trust checklists and IYKYK cards that help point out how you can improve acquisition. You may also see Problem Solver cards that highlight apps that solve specific issues.

! Beauty campaign pilot

Enter your info to have your products introduced to +5,000 beauty consumers.

#

Read more

January and February are historically the hardest months for Shopify beauty brands. Demand drops after the holidays, paid ads get riskier, and inventory sits longer than planned.

To offset that slowdown, we are running a limited Q1 Beauty Featured Partner Pilot. We will feature a small group of beauty brands to approximately 5,000 verified shoppers who have previously purchased beauty products from independent stores. This is not a traffic blast and not a marketplace. Shoppers click through to your store, purchase on your checkout, and we measure sell-through end to end. You keep the customer relationship. Zero cost: we cover the promotion for the pilot because we want clean data before we scale. In return, you get incremental exposure during the slowest months plus a post-campaign sell-through report. The only requirement: a 2-minute install and activation of the Tokuhn Network app so we can measure accurately. No theme edits. You can uninstall when the pilot ends.  AD PREFLIGHT

AD PREFLIGHT

Ad Readiness: Max CPC Check #Enter your estimated Revenue Per Visitor (RPV) and target buffer (aim for 2-3x based on 2025 benchmarks). 2025 Benchmark: Avg e-com RPV ~$1.80-3; if your max CPC > $1.16 (Google) or $0.63 (Meta), you're likely ready to test ads. Otherwise, boost RPV first! ! IYKYK

It is not you, it is them.

#

Most popular Shopify apps are not built for your

scale, so they focus you on the wrong things.

If you tried popular Shopify apps and felt let down, here is the truth: most were not designed for merchants like you. A low-priced tier is often a de-featured version of an enterprise product, not a tool built around small-merchant constraints. Read more

If you tried popular Shopify apps and felt let down, here is the truth: most were not designed for merchants like you. A low-priced tier is often a de-featured version of an enterprise product, not a tool built around small-merchant constraints. Enterprise gravity creates three traps: features that miss your real problems, roadmaps aimed at big-brand priorities, and benchmarks that assume high traffic and make healthy small-store numbers look broken. You end up pushing buttons without getting outcomes. If the promised results are not showing up, or doing more inside the tool does not move the needle, switch to software designed for your inputs from the start: your traffic, your list size, and your time budget.  Problem Solver

Problem Solver

Tokuhn Network #"Tokuhn is our lowest-cost acquisition channel. We only pay when a sale happens, so we can put offers in front of the entire network without worrying about wasted spend." - Raul Hadema, Convoy Car Care

Get distribution without buying clicks. Tokuhn puts your offer in front of qualified shoppers across the network and you only pay when they actually convert. This is how you scale acquisition safely. You get reach. You get new buyers. You're never upside down on ad spend because you're not paying for attention, you're paying for sales.  OFFER READY

OFFER READY

Offer Clarity Check #The goal is not to close the sale in one hit. The goal is to earn the right to follow up. If this list is not clean, do not expect the first send to convert. The job of the first send is to open the door. ! IYKYK

Sometimes the question is whether to buy ads at all.

#

Ads buy attention, not sales. Use this simple process

before you spend.

The right question is often not how to optimize ad spend, but whether to spend at all. Ads buy attention, not sales, and if your store cannot turn visits into orders at a high enough rate, ad dollars will lose money regardless of scale. Read more

The right question is often not how to optimize ad spend, but whether to spend at all. Ads buy attention, not sales, and if your store cannot turn visits into orders at a high enough rate, ad dollars will lose money regardless of scale. Run a profit check with four inputs: expected cost per click, click to visit ratio, site conversion rate, and contribution per order defined as AOV minus direct costs. The go or no-go rule is simple: conversion rate multiplied by contribution per order should be greater than or equal to cost per click. If the result is positive, proceed and monitor weekly. If it is negative, ask three questions: am I buying to learn and I know this run will not be profitable, am I buying repeat-friendly products with quick payback, or am I clearing inventory that loses value each week. If none apply, improve merchandising to raise conversion and improve gross profit by adjusting price or costs before buying media. Bottom line, ads buy attention and your store creates profit. Spend when the calculator is positive or the learning or inventory case is worth it. Otherwise, invest in conversion and margin first. ! IYKYK

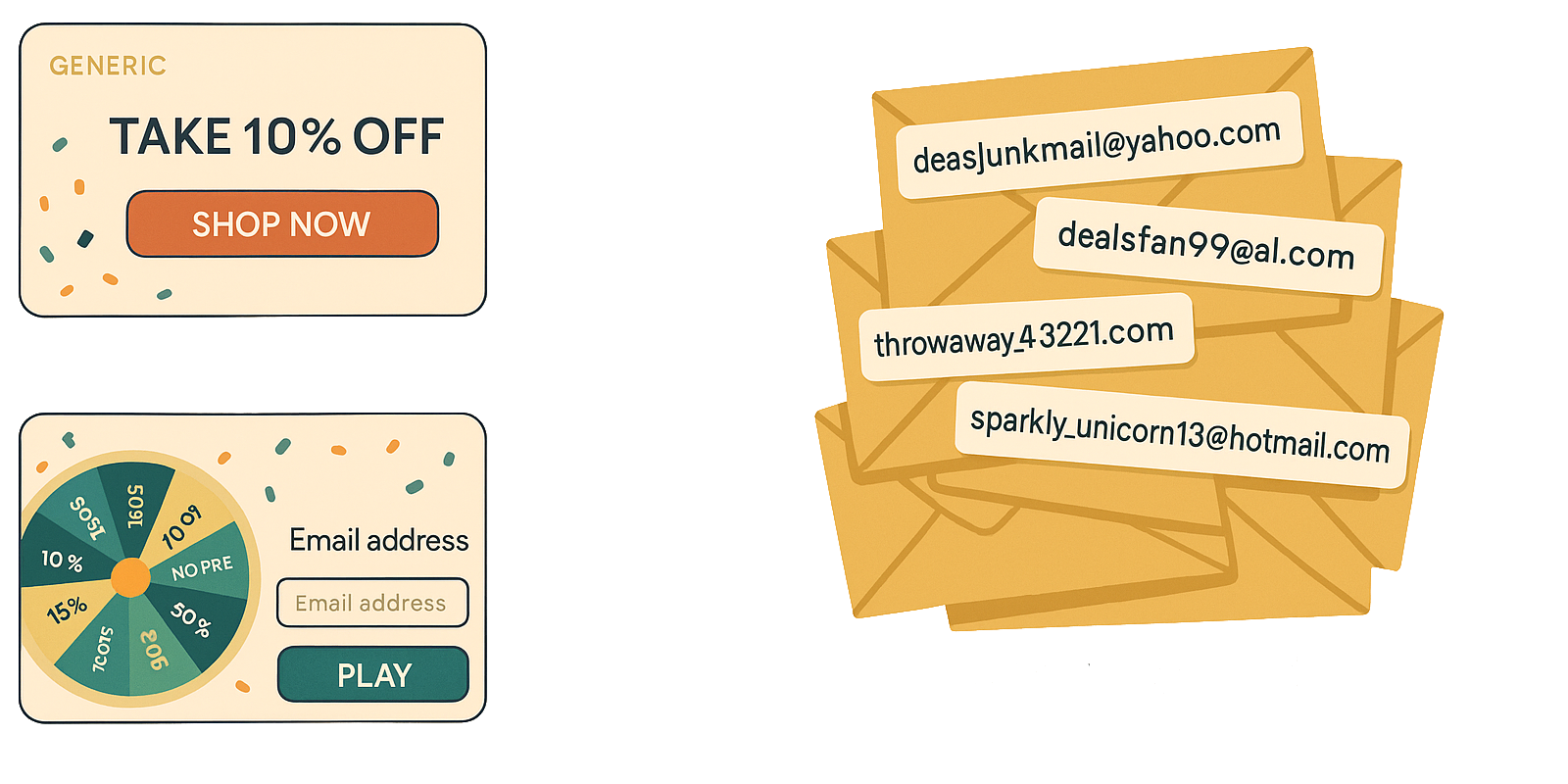

You do not need more emails, you need better ones.

#

Low-quality leads kill your list. Here is how to fix

it without gimmicks.

If your list feels dead - low opens, no clicks, spam complaints - you are not imagining it. Most popups chase quantity with spin wheels, exit-intent triggers, and loud designs with hidden close buttons, so you get junk emails and zero engagement. Read more

If your list feels dead - low opens, no clicks, spam complaints - you are not imagining it. Most popups chase quantity with spin wheels, exit-intent triggers, and loud designs with hidden close buttons, so you get junk emails and zero engagement. Here is what is actually happening: traditional popups are optimized for volume, not outcomes. They trade poor offers for poor emails and accept anything typed into the box. The result is throwaway addresses, fake accounts, and no intent to buy, so you end up with a list that looks big and performs like it is empty. Every fake email hurts your sender score, your real subscribers get fewer emails, your reputation tanks, and your best content goes to spam. A better list starts with verified emails captured via Google Sign-In or Apple, exchanged for a stronger offer that justifies a real address. Those leads open, click, and convert because they are real. No tricks and no bait. Provide enough value to earn a real email, and if you want more sales, stop chasing any email and capture the best. Path to Low-Quality Emails #

"Spin-to-win popups and generic 10% offers collect junk inboxes that never buy and

get you flagged as spam."

Problem Solver

Problem Solver

FashionPop #"FashionPop gives us real emails that actually open. We trade a strong first offer, and in return we get the customer's primary inbox, not fake accounts and not junk addresses." - Rachel, Columbia Leather Store

FashionPop is list building that isn't garbage. You make an offer that matters, and in exchange the shopper gives you the email they actually check. You walk away with real, warm contacts you can sell to again. If your list is full of trash emails, your offers never land. FashionPop fixes that. You're not guessing who to market to - you're in their real inbox on day one.  TRAFFIC BUY CHECK

TRAFFIC BUY CHECK

Paid Traffic Readiness #If any of these fail you are likely lighting ad spend on fire. If you cannot check all boxes, fix the page and the capture before you raise spend. Do not try to outbid a broken offer. ! IYKYK

10% off for everyone is worse than 30% off for a few.

#

Blanket discounts hurt pricing power and convert less.

Targeted incentives close more and cost less.

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Read more

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Offer 30% off to a well-chosen 20% instead. It hits harder, feels earned, and preserves pricing power while avoiding margin burn across the base. Promotion is about relevance, and merchandising is about trust, so a precise, targeted incentive does both jobs better. Stop treating 15% as a default. Use Acquire and Promotion to build segments, then send the right offer at the right time. How you discount matters more than how much. ! IYKYK

Your offer is the resume. The email is the interview.

#

Offers do not close sales. They open doors.

Most new customers do not buy right away. They come back two or three times if you are lucky. The offer is not the closer; it is the resume. It gets you noticed, earns attention, and wins permission to follow up. Read more

Most new customers do not buy right away. They come back two or three times if you are lucky. The offer is not the closer; it is the resume. It gets you noticed, earns attention, and wins permission to follow up. The sale is created by two systems working together: a strong email sequence that builds trust and timing, and merchandising that reinforces belief and desire on the site. If offers are not converting, it often means you expect the offer to do a job it was not built to do. Let the offer earn the email, then let the emails earn belief. Keep the door open with consistent follow-up so that when the moment is right, the purchase is easy. The resume gets you in the door; the interview gets the job. Capture Verified Leads

Google Sign-In

10-30% Coupons

Turn Visitors Into CustomersFashionPop converts more visitors at the moment of intent: Google Sign-In plus instant coupon equals more real, marketable customers in your Shopify store. Clear Value

No Exclusions

30-Day Timer

Coupons That ConvertPick 10%, 20%, or 30% off. Shoppers understand it instantly and redeem; simple, trustworthy, and effective. Shopify Sync

Marketing Opt-In

Clean Data

Own Your Customer DataEvery signup is for a unique customer with marketing opt-in and a clear tag for segmentation. No third-party list control. # Sell

Make the Offer Make Sense #

"Does the offer feel clear, fair, and safe, will it convert?"

This section answers that question. You'll see checklists that make your offer believable, and calculators that show what a discount really does to your margin (and how hard conversion now has to work to break even). You'll also see Problem Solver cards that add trust signals so you don't have to lean on "20% off" every time you want someone to click Buy. Strong Offer = Their Best Email #

"If the offer is real, no exclusions, no hoops, they'll give you the inbox they

actually read."

! IYKYK

10% off for everyone is worse than 30% off for a few.

#

Blanket discounts hurt pricing power and convert less.

Targeted incentives close more and cost less.

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Read more

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Offer 30% off to a well-chosen 20% instead. It hits harder, feels earned, and preserves pricing power while avoiding margin burn across the base. Promotion is about relevance, and merchandising is about trust, so a precise, targeted incentive does both jobs better. Stop treating 15% as a default. Use Acquire and Promotion to build segments, then send the right offer at the right time. How you discount matters more than how much.  LIST HEALTH

LIST HEALTH

Deliverability / List Quality#If you fail here, your emails will quietly die in junk and your promos will look "flat" even if the offer is good. If you can't check these, fix list quality before blaming "email is dead."  Problem Solver

Problem Solver

Brand Bench CRO Report #

Brand Bench reviews your store the way a head of growth would and gives you a

conversion report.

It benchmarks you against thousands of independent merchants, not generic best

practices.

The report covers trust signals, retargeting setup, landing page clarity, PDP copy,

merchandising, and more.

! IYKYK

The Rule of 7 does not mean what you think it does.

#

If your open rate is 14%, it is not 7 emails. It is

49.

You have heard it before: it takes 7 touches to make a sale. Those touches are opens, not sends, and the difference is massive. If your open rate is 14%, you do not need 7 emails; you need 49, because 7 divided by 0.14 is 49. Read more

You have heard it before: it takes 7 touches to make a sale. Those touches are opens, not sends, and the difference is massive. If your open rate is 14%, you do not need 7 emails; you need 49, because 7 divided by 0.14 is 49. This reframes progress. If you have sent 14, 21, or 35 emails without results, you may be halfway, not failing. Many merchants quit at the moment they should double down, assuming the audience is uninterested when the sequence simply needs more opens. Campaigns usually fail because follow-up stops too soon, not because the offer is weak. Keep sending, keep building trust, and keep earning attention. When the seventh open finally happens, you will be the one they remember. ! IYKYK

Swap junk emails for revenue recovery.

#

A one-time strong offer can clean your list and boost

engagement, without turning you into a discount machine.

If your email deliverability is tanking - more junk folder landings, lower opens, stalled sales - you are not stuck. The fix is not more sends or weaker incentives. It is upgrading your list quality with a smart exchange. Read more

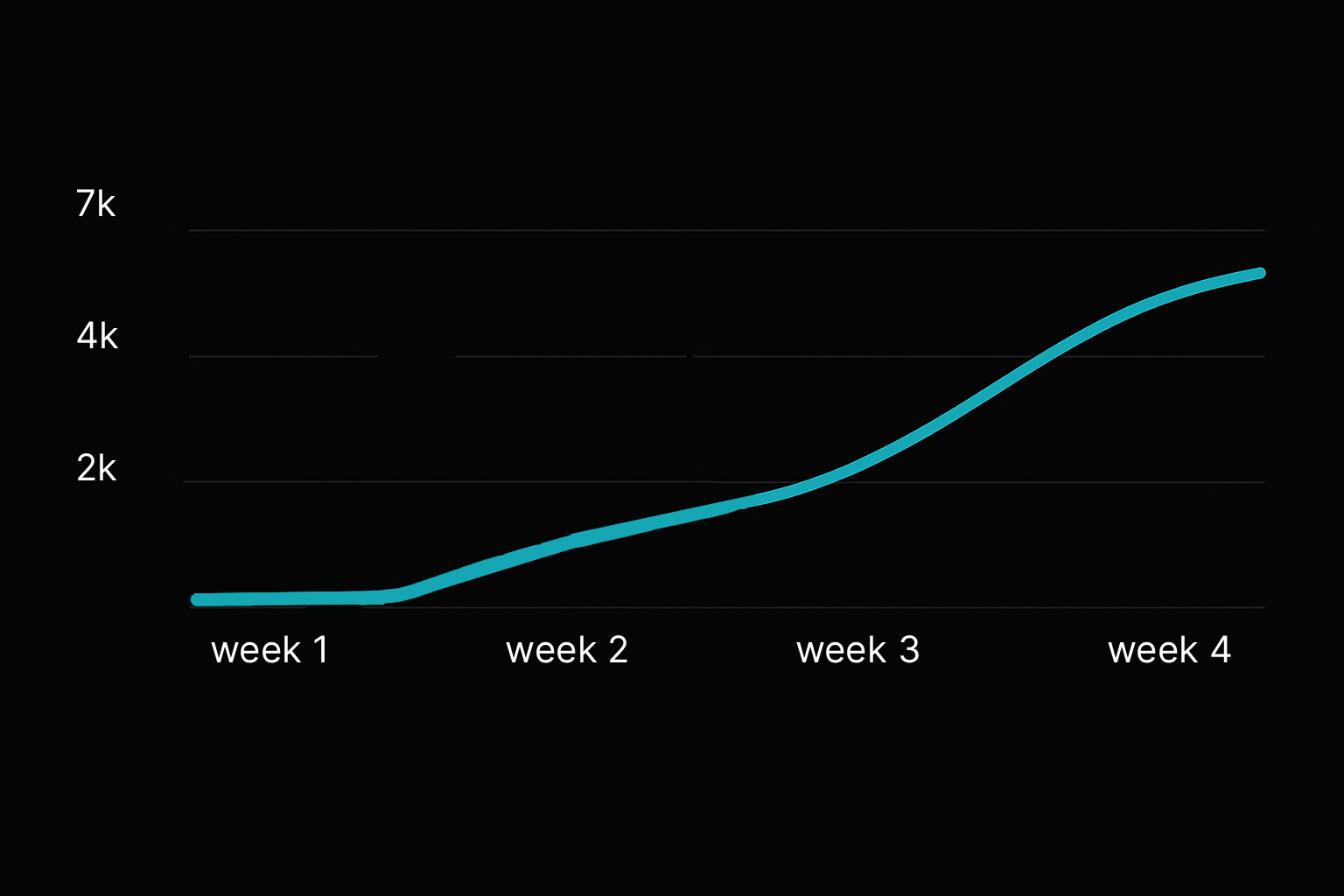

If your email deliverability is tanking - more junk folder landings, lower opens, stalled sales - you are not stuck. The fix is not more sends or weaker incentives. It is upgrading your list quality with a smart exchange. Here is the truth: most stores have bloated databases. Say you have 3,000 contacts; 1,500 to 2,500 might be low-quality, throwaways, inactives, or unverified emails that drag down your reputation. Reach out to your existing list with a strong, one-time offer: 30% off in exchange for a verified email such as Google or Apple sign-in. Why does this work? It is a clear value trade: they get a premium discount, and you get authenticated, high-engagement contacts. Those verified emails drive better opens and clicks, repairing your inbox placement over weeks with a steady cadence. Week one, fresh engagement starts. Week two, deliverability improves. Week three, revenue climbs as real buyers respond. It also rewards your install base without endless promos, limiting the always-on-sale vibe that erodes pricing power. What to do about it: segment low-engagement contacts, send one email that says "Upgrade your perks - share your verified email for 30% off now," and track the uplift as opens rise, junk rates drop, and sales recover. It is not about growing junk mail; it is about recovering what is yours with emails that actually work. Recover Real Emails You Can Actually Reach #

"Send a targeted offer that asks contacts to confirm with their Google-authenticated

inbox. You pull them

back into a real, deliverable email and unlock revenue sitting in your 'dead' list."

AD PERFORMANCE

AD PERFORMANCE

Ad Performance: ROAS vs. RPV/CPC#Input your ROAS (e.g., 4 for 4:1), RPV, and CPC to check if ratios align (RPV/CPC should typically exceed ROAS). 2025 Benchmark: Avg e-com ROAS 2.87-4:1; if RPV/CPC isn't higher, audit attribution.  TRUST CHECK

TRUST CHECK

Trust Before Conversion#Quick pass/fail checklist. If you miss any of these, your conversion rate will suffer even if your offer is good. If you cannot check all of these, fix trust before buying traffic.  Problem Solver

Problem Solver

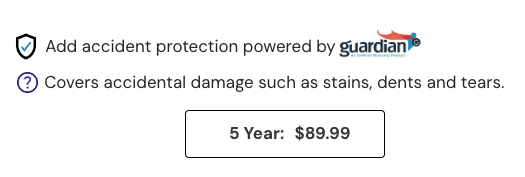

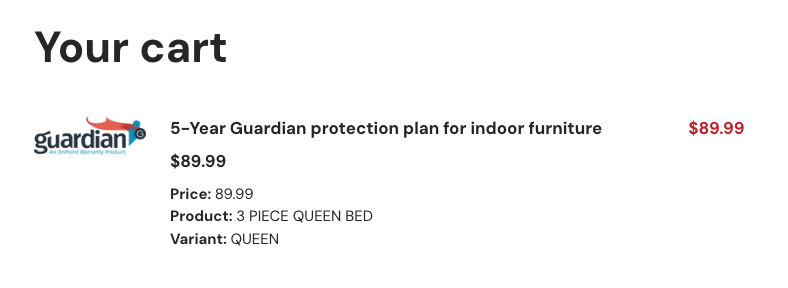

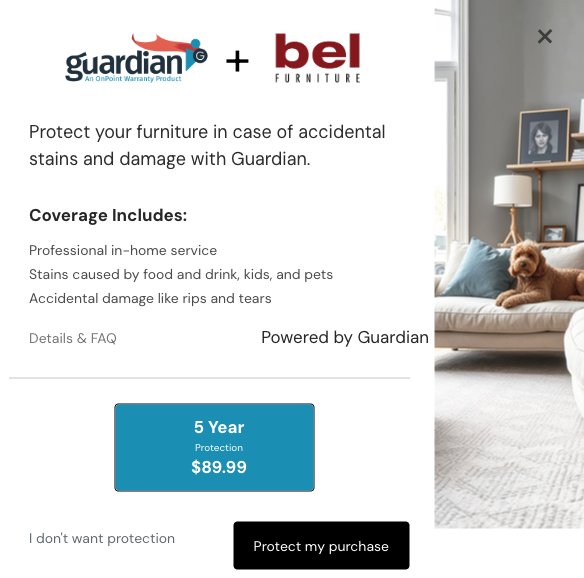

Instant Trust: Extended Coverage #"Guardian has transformed how we offer protection. We went from single-digit attach rates to over three times that number. It's a seamless fit for our Shopify store and a major win for both our customers and our bottom line." - Sid Mollai

Co-Founder, Bel Furniture

If shoppers hesitate because they are not sure they can trust you yet, Guardian adds real protection right on PDP / cart. You get conversion lift and upsell dollars, shoppers get peace of mind. This is how you look legitimate in the first 7 seconds, not after they dig through policy text. ! IYKYK

You have got 7 seconds.

#

Trust and appeal decide what happens next.

Most visitors are not your buyer, and that is fine, but every visitor judges fast. First, do I trust this store. Second, can I see why these products might appeal to someone, even if not me. If either answer is no, they are gone and they will not open your next email. Read more

Most visitors are not your buyer, and that is fine, but every visitor judges fast. First, do I trust this store. Second, can I see why these products might appeal to someone, even if not me. If either answer is no, they are gone and they will not open your next email. You do not need instant conversion; you need instant belief. Belief earns curiosity, and curiosity keeps the door open. A hiking stick does not have to sell a non-hiker; it only has to spark the thought that it would be perfect for someone they know. Nail the first impression and every follow-up gets easier. Miss it and you are cold again. Make them trust you and believe that someone will care within those first 7 seconds.  REPEAT DRIVER

REPEAT DRIVER

Second Order Plan#This is how you turn a one time buyer into a customer. If you cannot check these boxes, you are buying every order like it is the first order forever. ! IYKYK

Trust first, returns second or risk failing quietly without sales.

#

Big brands obsess over returns. Small stores win by

building trust first.

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Read more

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Without trust, no policy tweak converts a hesitant visitor. Trust lifts opens, clicks, and buys across every step, and returns only matter after you have won the sale. Virtually no small store fails from high returns; they fail from low sales amplified by low trust. Lead with trust and make the return promise short, plain, and visible everywhere. Use one line such as "Free 30-day returns," put it on the first screen of emails and above the fold on pages, and repeat it in cart and checkout. Do not hide it, complicate it, or bury it for creative space. Check it before every campaign and recheck monthly. Nail visibility on returns to earn the first yeses, grow sales, and then tune details later.  Problem Solver

Problem Solver

Turn Returns Into Revenue #"This app has provided us a simple way to manage open-box clothing and accessories, which is a smaller part of our overall business but it helped us quickly list a few returned and lightly damaged items. The team was helpful and quick to respond when we had questions!" - Golden Hour Farm

Returns and open-box items do not have to be a loss. Pharaoh lets you resell them on your own site as Open Box instead of writing them off. You already paid CAC for these products. Pharaoh just lets you get that value back.  COALITION VALUE

COALITION VALUE

Coalition Value (2.7% network fee on every sale) #Enter the first order value and your estimated LTV. The calculator shows total network fees on attributed revenue, first order net after the 2.7% fee, lifetime net after fees, and the LTV to fees multiple. Benchmark: With a 2.7% fee on all attributed sales, the first order nets 97.3% of revenue. A healthy result keeps lifetime net after fees clearly positive and shows a strong LTV to fees multiple.  MARGIN PROTECT

MARGIN PROTECT

Offer Profit Safety Check#Use this before you run a sale or send an aggressive offer. If this fails, do not scale that offer. You will move units and make no money. ! IYKYK

The trust checklist to run before you hit send.

#

8 quick pass-fail checks that prevent lost orders and

refunds

Trust wins orders, so run a 2-minute pass-fail before any promotion. Confirm that the email, landing page, and site look professional and consistent in branding, colors, voice, tone, fonts, and product claims, and verify that prices never rise along the journey from ad or email to PDP, cart, and checkout. Read more

Trust wins orders, so run a 2-minute pass-fail before any promotion. Confirm that the email, landing page, and site look professional and consistent in branding, colors, voice, tone, fonts, and product claims, and verify that prices never rise along the journey from ad or email to PDP, cart, and checkout. Ensure the coupon or offer is frictionless and honest, with auto-apply or one tap, that it works on the promoted items including sale items or that any exclusions are clearly stated in the first screen, and that the final price matches the promise with no gotchas. Put a clear shipping and return promise in the first screen, keep store name and visuals consistent from email to landing page, and place real product photos above the fold. Position ratings with review count near the CTA and add one short, specific review snippet close to the buy zone. When every line passes, send. If any line fails, fix it first. Expand Your Reach with Tokuhn Network

Tokuhn Network connects small e-commerce merchants with a broader audience. By joining the network, you tap into a community of customers eager to discover new brands and support small businesses. No Upfront Costs, No Monthly Fees

Pricing: 2.7% of every non-returned purchase from customers we introduced. No monthly fees. No upfront costs. Tokuhn points drive purchases across the network.

With Tokuhn Points, customers earn rewards they can use at any merchant in the network, encouraging them to come back and make repeat purchases with trusted brands. Keep Customer Data in Your Hands

Tokuhn Network allows you to retain full control of your customer relationships and data, empowering you to build lasting connections without third-party interference. Specifically Designed for Small Merchants

Our platform is built with the needs of small e-commerce merchants in mind, offering a simple, affordable way to grow without complex integrations or high costs. # Grow

Win the First Order Without Bleeding Out #

"Can I afford to buy this customer at all and still survive the first order?"

This section is about acquisition economics. You only get one first purchase. If that purchase loses too much money, scaling will break you. You'll see calculators that tell you your true CAC ceiling on order one, and where you're quietly losing margin to fulfillment, returns, and incentives. You'll also see Problem Solver cards that turn hesitation into recovered dollars. ! IYKYK

Why the vendor's advice does not seem to work for my store.

#

Your vendors want you to win, but big-merchant gravity

shapes their playbooks.

This is not about bad actors. Most vendors want you to succeed and care about your results. The issue is gravity that pulls inputs from the largest customers and projects them as general guidance. Read more

This is not about bad actors. Most vendors want you to succeed and care about your results. The issue is gravity that pulls inputs from the largest customers and projects them as general guidance. Market research interviews the biggest accounts, product research prioritizes their requests, case studies showcase eye-catching logos and numbers, and benchmarks are drawn from high-traffic stores. None of that is malicious; it is simply where the data and ROI live, but it creates a mismatch for smaller stores. When lessons are extracted from large-merchant inputs, the guidance is often off, wrong, or even inverted for most merchants. The fix is to use guidance built for your category, size, and maturity, and to be comfortable replacing vendor conventional wisdom when it does not fit. This does not mean the vendors are wrong. It means their insights may not apply to your inputs, constraints, or outcomes.  TRAFFIC GATE

TRAFFIC GATE

Breakeven CPC Gate#Can you afford to buy paid clicks right now. If expected value per click is lower than cost per click, stop. Rule: conversion_rate_decimal x contribution_per_order should be greater than or equal to CPC.  Problem Solver

Problem Solver

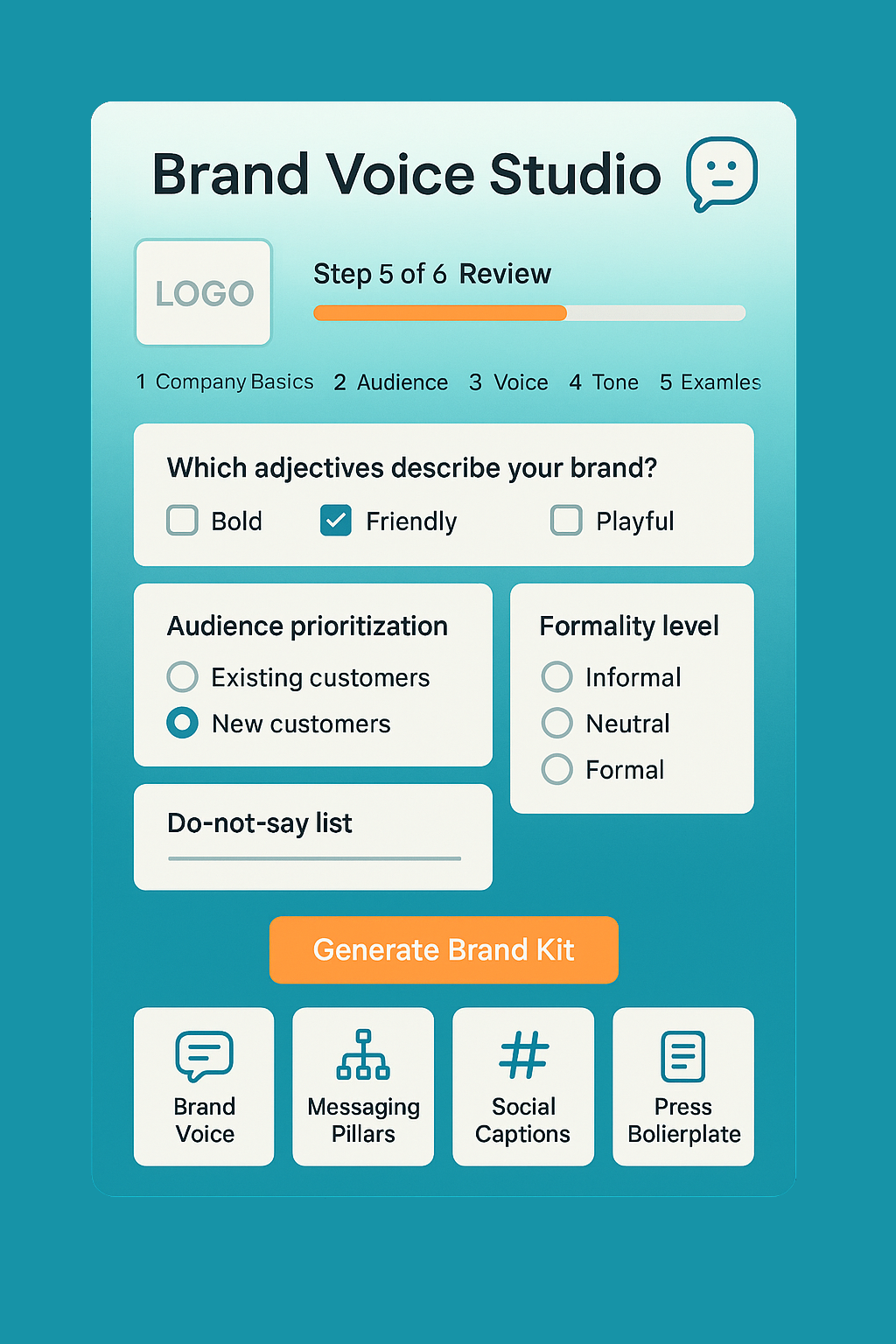

Brand Book Powered by Coalesce® #

Brand Book creates trust-building documents for your store using our Coalesce®

platform.

The output is not copy ideas, it's an aligned system: how you talk, what you

promise,

and how you show up everywhere (site, emails, PDPs, support, ads).

When every surface sounds like the same company, same mission, same tone, same value

prop -

customers trust you faster. That is a conversion lift. It's also a return-rate

reducer.

CHECKOUT FRICTION

CHECKOUT FRICTION

Cart / Checkout Pass-Fail #If any of these are broken, you are paying for traffic just to watch it stall at the pay button. If this fails, fixing the checkout leaks is higher ROI than buying more traffic.  DISCOUNT LIFT

DISCOUNT LIFT

Discount Margin and Lift#Check how much profit per order you keep after a discount and how much harder the page now has to convert. If required lift is 1.4x, that means you now need 40 percent more conversions just to tie.  CAC CEILING

CAC CEILING

First Order CAC Ceiling#How much can you spend to win a brand new customer on order one and still be safe. Reference model: 30 percent of first order, capped at 25 dollars, paid once for a new customer only.  REPEAT VALUE

REPEAT VALUE

Second Order Value #This tells you how much profit is left after 2 orders and whether your win-back incentive is still safe. If you stay net positive after two orders, you can justify real incentives to bring them back.  Problem Solver

Problem Solver

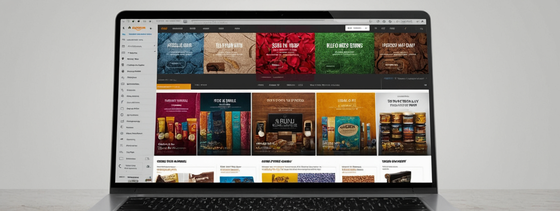

Tokuhn Shop #Tokuhn Shop is free for the merchant. It's built as an endless boutique for independent brands, shoppers browse products from 1,500+ merchants in one place. Examples live in Tokuhn Shop right now:

Ember Street Co., IronPeak Labs, Finch Carry, Nightshift Coffee Co., Bark & Foundry, North Ridge Gear, Quiet Kiln Studio, Luma Field Skin, Violet Harbor Jewelry, Second Run Denim, Everkiln Ceramics, Driftwood Provision Co., Arc & Alder Tools, Field Theory Botanicals, Ghost Shift Moto Care, Saltline Swim, Tiny Forge Pet Hardware, Bramble & Beam Home, Apex Trail Supply, Honeytone Wellness Add a new acquisition surface without buying cold clicks. Let shoppers find you while they're already looking at products like yours. ! IYKYK

The customer drop-off you are worried about is not the one that is killing you.

#

Monitor churn at the bottom. Fix losses at the top.

That is where the leverage is.

Many teams obsess over post-purchase churn, but the bigger leak happens before the first order. Acquisition fails when junk opt-ins cannot be reached, promotion fails when messages are off-time or off-message, and merchandising fails when the site does not help a visitor choose with confidence. Read more

Many teams obsess over post-purchase churn, but the bigger leak happens before the first order. Acquisition fails when junk opt-ins cannot be reached, promotion fails when messages are off-time or off-message, and merchandising fails when the site does not help a visitor choose with confidence. This pre-order drop-off quietly kills growth. With 50,000 impressions, 5,000 opted-in contacts, 1,000 orders, and a 2.5% repurchase rate, a 10% lift that flows through to first orders adds around 100 new orders, while a 10% lift in repurchases only adds a few. If they never buy once, there is nothing to grow. Do not skip straight to Grow. Earn Grow by passing the first test: turn a curious visitor into a real customer, then improve repurchase once the base is healthy. ! IYKYK

You are not doing it wrong. You are just not a rocket ship ... yet.

#

Most expert advice is built on exceptions, not the

average.

If expert advice has not worked for your store, you are not alone. You are likely not doing it wrong. Podcasts, blogs, and conferences reward dramatic stories, and good stories lean on turning points, exceptional outcomes, and simple takeaways. Read more

If expert advice has not worked for your store, you are not alone. You are likely not doing it wrong. Podcasts, blogs, and conferences reward dramatic stories, and good stories lean on turning points, exceptional outcomes, and simple takeaways. That is the trap. They treat the exception as the average and present it as a roadmap. Your store is probably not a rocket ship, and most stores are not. Most merchants are grinding, earning every visitor, every open, and every dollar. When those tips do not work, it is usually because the strategy assumes magic inputs you do not have. Focus on the boring basics that compound: sustainable cadence, predictable improvement, and discouragement-free execution. That is what builds real progress when you are not the exception. Discover with Delight

Venture into a world where every item has a story and every purchase supports a dream. At Tokuhn, we curate an inspiring selection of goods from small but mighty merchants with hearts as big as their ambitions. Small brands with grand visions

Small brands with grand visions find a home at Tokuhn. We believe in the power of community, the spark of innovation, and the strength in collaboration. If you are ready to unfold your brand's potential and share your craft with a captivated audience, we are here to amplify your voice. Your insights light the way

Share your voice. Tell us about the features that excite you, the experiences that delight you, and the dreams you envision for our community. Your input is the cornerstone of our growth. Our Promise to You

Tokuhn was crafted to be a sanctuary for small brands with big dreams. We are not just a platform. We are a partnership, a community, and a family. Tell us your story, share your passion, and let's make magic happen together. We are here for you every step of the way.

Tokuhn Network CampaignsCo-market across indie brands with context, so you reach new buyers without spam.

Tokuhn ThreadsPredict who is ready to buy, make the right offer, and protect your margins. # Thrive

Operate Like You're Not Alone #

"Am I making the right moves or am I just guessing in the dark?"

Thrive is about leverage. Not just "more sales," but smarter decisions, faster. This section pulls from Tokuhn's network and the Tokuhn 2400' real performance data from stores like yours' so you can see what's actually working in the wild instead of guessing. It's not theory. It's signal. You'll also see tools built on our AI platform that help you apply those insights across every pillar.  Problem Solver

Problem Solver

Tokuhn Product Dataset #

We publish TSMPD-US-Public-v1_1, an open product dataset designed so independent

brands can show up in AI shopping results.

So far, it has been downloaded more than 2,000 times and includes over 67 million

products

from 355,000 indie merchants. That means AI systems that pull from this data can

recommend indie products at scale.

Adding your catalog means your products become eligible to surface when someone asks an AI assistant "what should I buy?". ! IYKYK

Trust first, returns second or risk failing quietly without sales.

#

Big brands obsess over returns. Small stores win by

building trust first.

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Read more

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Without trust, no policy tweak converts a hesitant visitor. Trust lifts opens, clicks, and buys across every step, and returns only matter after you have won the sale. Virtually no small store fails from high returns; they fail from low sales amplified by low trust. Lead with trust and make the return promise short, plain, and visible everywhere. Use one line such as "Free 30-day returns," put it on the first screen of emails and above the fold on pages, and repeat it in cart and checkout. Do not hide it, complicate it, or bury it for creative space. Check it before every campaign and recheck monthly. Nail visibility on returns to earn the first yeses, grow sales, and then tune details later. ! IYKYK

The trust checklist to run before you hit send.

#

8 quick pass-fail checks that prevent lost orders and

refunds

Trust wins orders, so run a 2-minute pass-fail before any promotion. Confirm that the email, landing page, and site look professional and consistent in branding, colors, voice, tone, fonts, and product claims, and verify that prices never rise along the journey from ad or email to PDP, cart, and checkout. Read more

Trust wins orders, so run a 2-minute pass-fail before any promotion. Confirm that the email, landing page, and site look professional and consistent in branding, colors, voice, tone, fonts, and product claims, and verify that prices never rise along the journey from ad or email to PDP, cart, and checkout. Ensure the coupon or offer is frictionless and honest, with auto-apply or one tap, that it works on the promoted items including sale items or that any exclusions are clearly stated in the first screen, and that the final price matches the promise with no gotchas. Put a clear shipping and return promise in the first screen, keep store name and visuals consistent from email to landing page, and place real product photos above the fold. Position ratings with review count near the CTA and add one short, specific review snippet close to the buy zone. When every line passes, send. If any line fails, fix it first.

Tokuhn Coalesce®

Coalesce is one component of our AI platform that addresses a core limitation of LLMs. LLMs are built to emit the most predictable next word-great for fluid experiences, but it can lead to false precision. Coalesce replaces the loudest opinion with expert guidance. The Hackathon SparkIn 2023, Tokuhn's founders challenged the status quo at our first hackathon. Frustrated by crowdsourced noise producing popular guesses instead of precise solutions, we asked: can AI channel expert wisdom instead? The answer was Coalesce. The Expert CoalitionBuilt with insights from enterprise and e-commerce leaders, Coalesce fuses curated expertise into a decision layer that reduces overconfident errors and delivers tailored strategies for e-commerce success.

Tokuhn Precipitate®

Precipitate is a component of our AI platform that distills patterns from sparse signals, aggregating behaviors across the merchant network into a global model. It provides foundational predictions derived from network-wide patterns. The Inspiration SparkWe asked: could we adapt lessons from TikTok's algorithm to e-commerce? The result was Precipitate, turning network-level patterns into scalable AI infrastructure for indie e-commerce. The Global CoalitionInspired by advances in scalable embeddings and online training, Precipitate fuses sparse merchant data into a resilient platform. It handles long-tail behaviors-like infrequent buys or seasonal trends-while preserving privacy, delivering the backbone for data-driven predictions. Tokuhn 2400 - Research & Benchmarks

The Tokuhn 2400 distills patterns across indie merchants, finding where spend is wasted, what reliably moves CVR, and how to sequence offers, trust, and network reach for compounding lift. Key insights we publish

Free tools - Brand Bench & Brand Book

Brand Bench gauges your store against 4,000+ shops, exposing sales killers with sharp insights. Ignite growth with tactics that convert clicks into loyal buyers. Brand Book crafts your unified brand with dynamic strategies and definitions. Spark trust and loyalty with a voice that connects across every customer touchpoint.  Problem Solver

Problem Solver

Public Shopify Apps #"Tokuhn helped us turn our idea for Pharaoh reselling open-box and returned items instead of writing them off into a fully functional Shopify service. Now any merchant can unlock margin from open-box inventory without custom code." - Luke, Pharaoh

Some businesses shouldn't just pitch merchants; they should live inside the

merchant's store.

! IYKYK

One size does not fit your store. Build what does.

#

Some merchants have unique challenges and unique

ideas.

Off-the-shelf tools do not always solve them.

Most apps are built for the median merchant. If your store has unusual catalog rules, bundling, pricing, fulfillment, or buyer behavior, the one-size approach caps your outcome. Read more

Most apps are built for the median merchant. If your store has unusual catalog rules, bundling, pricing, fulfillment, or buyer behavior, the one-size approach caps your outcome. Tokuhn builds focused Shopify apps to solve the specific thing holding you back. We align to your funnel work: Acquire, Sell, Grow, Thrive, and implement only what moves your metrics. Examples include verified email capture without gimmicks, price-guarantee logic, coalition points and offers, POS line-item actions, store-branded protection, or a feature that exists only in your head today. The result is an edge your competitors cannot download, with data and workflow that match how you operate. One size does not always fit all. When you have a unique challenge or a unique insight, build what is yours.  Problem Solver

Problem Solver

Custom Revenue Apps #"Tokuhn built a Shopify app that lets our partner offer warranties inside their stores; right in the flow, no engineering required on their side. We went from "can you do this?" to "it's live and making money fast." - Jackie, OnPoint Warranties

Guardian asked us to build a custom app their Shopify partner could use to sell

protection

plans. We packaged the offer, wired the warranty, and shipped

an app the partner could turn on and start selling.

This is what we do for partners: take an idea

and turn it into something that solves their problems.

|

The Tokuhn NetworkThe Tokuhn Network empowers small merchants by connecting them to new customers while ensuring they retain control over their data and relationships. Grow affordably and confidently with no upfront costs or monthly fees.

Earn Valuable PointsConsumers earn Tokuhn Points with every purchase at network merchants, redeemable across stores for discounts. Make every transaction more rewarding while supporting independent brands.

Build Loyalty Across StoresWith Tokuhn Points, customers can redeem rewards at any network store, driving repeat purchases and loyalty to small, independent brands.

Expand Your ReachTokuhn Network provides visibility across a wide audience of customers who value small, independent brands. Reach more people eager to discover unique products and support local businesses. Acquire New Customers

No Upfront Costs

Join A Community

Ignite Your PassionDiscover curated collections at the Tokuhn Shop, where every search leads to intentional finds and delightful surprises. Start your journey today and uncover the unexpected. Acquire New Customers

No Upfront Costs

Join A Community

Meet the MakersAt the Tokuhn Shop, every item has a story. Celebrate the artisans and entrepreneurs behind your favorite finds and experience the soul in every product. Acquire New Customers

No Upfront Costs

Join A Community

Search with SofiaSofia, your AI shopping assistant, is here to guide you through the Tokuhn Shop. Let her help you find treasures that support small brands with big dreams. Acquire New Customers

No Upfront Costs

Join A Community

Discover with DelightVenture into a world of stories and dreams. The Tokuhn Shop connects you with small merchants and their inspiring creations, making every purchase a meaningful experience. |

Install

Tokuhn NetworkAcquire New Customers

No Upfront Costs

Join A Community

Ad Network for Indie MerchantsTokuhn Network sends proven indie buyers to your store. It is inexpensive, predictable, and simple. No budgets or bids. Retargeting is included as a feature to finish more checkouts.

What is the Tokuhn Network?Tokuhn is an ad network for indie brands. Shoppers use Tokuhn points to claim your offer, then buy on your site. You keep the customer and the data. Ad NetworkTokuhn brings first-time buyers to your store. Shoppers use Tokuhn points to claim your welcome offer, then check out on your site. You keep the customer and the data. Pricing is simple: pay 2.7% on every non-returned purchase from customers we introduce. No monthly fees. No upfront costs. You control the offer. New CustomersTap into the Tokuhn Network to reach buyers who would not find you on their own. We send ready-to-shop consumers to your store. No upfront costs. Orders happen on your site. You keep the data. Install, set your offer, and go live in minutes. Affordable GrowthGrow without burning cash up front. Tokuhn is a performance ad network for indie brands with no monthly fees and no setup costs. You pay 2.7% only after a non-returned purchase from a customer we introduced. Orders happen on your site and you keep the data. Install, set your offer, and go live in minutes. Data ControlWith the Tokuhn Network, you maintain complete control over your customer data and relationships. Unlike many affiliate-style programs, where customer information is retained by the platform, Tokuhn ensures that every purchase is made directly on your Shopify store. This means you gain valuable customer insights, build your own database, and foster meaningful connections for future marketing and sales. Tokuhn helps you grow your customer base without sacrificing control or independence. Expand Your Reach with Tokuhn Network

Tokuhn Network connects small e-commerce merchants with a broader audience. By joining the network, you tap into a community of customers eager to discover new brands and support small businesses. No Upfront Costs, No Monthly Fees

Join the Tokuhn Network at zero cost. Pay only when you gain a new customer, making this the most affordable acquisition channel for small merchants striving to grow. Build Customer Loyalty Across Brands

With Tokuhn Points, customers earn rewards they can use at any merchant in the network, encouraging them to come back and make repeat purchases with trusted brands. Keep Customer Data in Your Hands

Tokuhn Network allows you to retain full control of your customer relationships and data, empowering you to build lasting connections without third-party interference. Specifically Designed for Small Merchants

Our platform is built with the needs of small e-commerce merchants in mind, offering a simple, affordable way to grow without complex integrations or high costs. |

Install

Verified Leads

Google Sign-In Coupons That Convert

Standard Coupons Auto-Recognize Returning Shoppers

10-20%

Lead capture lift

4×

More Primary Emails

$4.99

Unlimited leads / mo

Setup

Step 1. Add the app. Why Merchants Choose FashionPopPurpose-built for fashion merchants. Clear incentives for shoppers. Clean data for your CRM.

Pricing

40 leads free

Free (40 verified leads/mo) or Unlimited ($4.99/mo).

|

Tokuhn ShopAcquire New Customers

No Upfront Costs

Join A Community

Discover Unique Products at the Tokuhn ShopThe Tokuhn Shop showcases products from 1,500 small merchants. Discover hidden gems and shop directly from independent stores. Acquire New Customers

No Upfront Costs

Join A Community

Ignite Your PassionDiscover curated collections in the Tokuhn Shop, where every search leads to intentional finds and delightful surprises. Start your journey today and uncover the unexpected. Acquire New Customers

No Upfront Costs

Join A Community

Meet the MakersIn the Tokuhn Shop every item has a story. Celebrate the artisans and entrepreneurs behind your favorite finds and experience the soul in every product. Acquire New Customers

No Upfront Costs

Join A Community

Search with SofiaSofia, your AI shopping assistant, is here to guide you through the Tokuhn Shop. Let her help you find treasures that support small brands with big dreams. Acquire New Customers

No Upfront Costs

Join A Community

Discover with DelightVenture into a world of stories and dreams. The Tokuhn Shop connects you with small merchants and their inspiring creations, making every purchase a meaningful experience. |

Top PicksWhat is Tokuhn's Top Picks?Tokuhn's Top Picks allows you to showcase your best products with beautifully designed badges that enhance visibility, credibility, and urgency. With customizable styles, placements, and effects, Top Picks helps your products stand out and drives sales like never before.

Customizable BadgesChoose from over 300 badge combinations to fit your store's style.

Selected PlacementPosition badges in any corner and rotate them to suit your needs.

Increased VisibilityCatch the attention of your shoppers with eye-catching designs. Elevate Your Products with Tokuhn's Top PicksBoost Sales

Enhance Product Visibility

Save Time

Customizable Options

Increase Customer Trust

Acquire New Customers

No Upfront Costs

Join A Community

Showcase Your Top PicksWith Tokuhn Top Picks, merchants can spotlight up to four products, making it easier for customers to find and purchase your best offerings.

|

Pharaoh Open-Box

Pharaoh Open-BoxVisit Pharaoh

Tokuhn Builds Shopify Apps - For Us and For PartnersWe design, build, and operate production-grade apps that help small merchants grow. Alongside Tokuhn-branded products, we also build apps for other companies as their product and engineering partner. We helped Pharaoh deliver Pharaoh Open-Box, which converts returns and open-box items into sales with grading, quick listings, and a PDP price ribbon.

Boost Revenue With

|

Guardian Protection Plans

Visit Guardian

Tokuhn builds for Guardian - production-grade apps that lift attach rateGuardian's Shopify solution makes protection plans a natural part of the purchase journey. The integration is native and fast to deploy, and the offer appears where it converts best - on the product page, in the cart, and during checkout - without adding friction. Merchants see measurable results: higher plan attach rates, a meaningful lift in warranty revenue, and a cleaner customer experience with one-click add for up to five-year protection. Implementation is measured in days, not months, and the experience stays performant at scale.

Boost revenue with plans customers actually chooseClear plan value on the PDP increases consideration early - before customers hit the cart. "Guardian made protection plans easy to understand and impossible to miss on our product pages. Attach rate lifted immediately without slowing conversions." - E-commerce Director, U.S. furniture retailer

One-click add in cart and checkoutA frictionless, single-tap add keeps momentum high and lifts attach rate without disrupting conversion. "Adding a plan is literally a single click in the cart. It's seamless for the customer and a meaningful new revenue stream for us." - Co-founder, multi-location retailer

Branded, transparent plan detailsA clean, brand-matched modal explains coverage in plain language so customers know exactly what they're buying.

Right plan, right momentGuardian's selector makes it easy to compare terms and choose the best plan - no clutter, no confusion.

|

Tokuhn Network Learning HubUnlock your e-commerce potential with Tokuhn Network's comprehensive guides. Tailored for small merchants, these resources cover loyalty programs, collaborative growth strategies, and performance insights to help you thrive. Guided Learning for Merchant Success Essential Guides for E-Commerce GrowthMastering Loyalty and Customer RetentionDive into the complexities of loyalty programs designed for small merchants. Learn how to build a program that works for your business size and how to leverage coalition gift cards to boost customer engagement. Topics Covered: Loyalty Program Strategies, Coalition Gift Cards Start GuideBuilding a Collaborative Merchant NetworkUnderstand the dynamics of collaboration among Shopify merchants. Discover strategies for maximizing profitability through joint marketing efforts, managing risk in partnerships, and unlocking growth with coalition networks. Topics Covered: Collaboration Strategies, Risk Management in Partnerships Start GuideMarket Insights and Performance OptimizationExplore data-driven insights from Tokuhn's 1,000 Merchant Cohort and quarterly observations. Learn which Shopify app categories are impacting e-commerce the most and how to manage open-box returns profitably during peak seasons. Topics Covered: Merchant Cohort Analysis, App Impact on E-Commerce, Open-Box Return Management Start GuideIf You Know You Know...or Maybe Not

! IYKYK

It is not you, it is them.

#

Ads buy attention, not sales. Use this simple process

before you spend.

The right question is often not how to optimize ad spend, but whether to spend at all. Ads buy attention, not sales, and if your store cannot turn visits into orders at a high enough rate, ad dollars will lose money regardless of scale. Read more

The right question is often not how to optimize ad spend, but whether to spend at all. Ads buy attention, not sales, and if your store cannot turn visits into orders at a high enough rate, ad dollars will lose money regardless of scale. Run a profit check with four inputs: expected cost per click, click to visit ratio, site conversion rate, and contribution per order defined as AOV minus direct costs. The go or no-go rule is simple: conversion rate multiplied by contribution per order should be greater than or equal to cost per click. If the result is positive, proceed and monitor weekly. If it is negative, ask three questions: am I buying to learn and I know this run will not be profitable, am I buying repeat-friendly products with quick payback, or am I clearing inventory that loses value each week. If none apply, improve merchandising to raise conversion and improve gross profit by adjusting price or costs before buying media. Bottom line, ads buy attention and your store creates profit. Spend when the calculator is positive or the learning or inventory case is worth it. Otherwise, invest in conversion and margin first. ! IYKYK

Swap junk emails for revenue recovery.

#

A one-time strong offer can clean your list and boost

engagement, without

turning you into a discount machine.

If your email deliverability is tanking - more junk folder landings, lower opens, stalled sales - you are not stuck. The fix is not more sends or weaker incentives. It is upgrading your list quality with a smart exchange. Read more

If your email deliverability is tanking - more junk folder landings, lower opens, stalled sales - you are not stuck. The fix is not more sends or weaker incentives. It is upgrading your list quality with a smart exchange. Here is the truth: most stores have bloated databases. Say you have 3,000 contacts; 1,500 to 2,500 might be low-quality, throwaways, inactives, or unverified emails that drag down your reputation. Reach out to your existing list with a strong, one-time offer: 30% off in exchange for a verified email such as Google or Apple sign-in. Why does this work? It is a clear value trade: they get a premium discount, and you get authenticated, high-engagement contacts. Those verified emails drive better opens and clicks, repairing your inbox placement over weeks with a steady cadence. Week one, fresh engagement starts. Week two, deliverability improves. Week three, revenue climbs as real buyers respond. It also rewards your install base without endless promos, limiting the always-on-sale vibe that erodes pricing power. What to do about it: segment low-engagement contacts, send one email that says "Upgrade your perks - share your verified email for 30% off now," and track the uplift as opens rise, junk rates drop, and sales recover. It is not about growing junk mail; it is about recovering what is yours with emails that actually work. ! IYKYK

You do not need more emails, you need better ones.

#

Low-quality leads kill your list. Here is how to fix it

without gimmicks.

If your list feels dead - low opens, no clicks, spam complaints - you are not imagining it. Most popups chase quantity with spin wheels, exit-intent triggers, and loud designs with hidden close buttons, so you get junk emails and zero engagement. Read more

If your list feels dead - low opens, no clicks, spam complaints - you are not imagining it. Most popups chase quantity with spin wheels, exit-intent triggers, and loud designs with hidden close buttons, so you get junk emails and zero engagement. Here is what is actually happening: traditional popups are optimized for volume, not outcomes. They trade poor offers for poor emails and accept anything typed into the box. The result is throwaway addresses, fake accounts, and no intent to buy, so you end up with a list that looks big and performs like it is empty. Every fake email hurts your sender score, your real subscribers get fewer emails, your reputation tanks, and your best content goes to spam. A better list starts with verified emails captured via Google Sign-In or Apple, exchanged for a stronger offer that justifies a real address. Those leads open, click, and convert because they are real. No tricks and no bait. Provide enough value to earn a real email, and if you want more sales, stop chasing any email and capture the best. ! IYKYK

10% off for everyone is worse than 30% off for a few.

#

Blanket discounts hurt pricing power and convert less.

Targeted incentives

close more and cost less.

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Read more

Many stores default to 15% off sitewide and wonder why conversions stall. A weak discount for everyone does less than a strong offer for the right few, because small, permanent markdowns train customers to ignore urgency and distrust full price. Offer 30% off to a well-chosen 20% instead. It hits harder, feels earned, and preserves pricing power while avoiding margin burn across the base. Promotion is about relevance, and merchandising is about trust, so a precise, targeted incentive does both jobs better. Stop treating 15% as a default. Use Acquire and Promotion to build segments, then send the right offer at the right time. How you discount matters more than how much. ! IYKYK

Your offer is the resume. The email is the interview.

#

Offers do not close sales. They open doors.

Most new customers do not buy right away. They come back two or three times if you are lucky. The offer is not the closer; it is the resume. It gets you noticed, earns attention, and wins permission to follow up. Read more

Most new customers do not buy right away. They come back two or three times if you are lucky. The offer is not the closer; it is the resume. It gets you noticed, earns attention, and wins permission to follow up. The sale is created by two systems working together: a strong email sequence that builds trust and timing, and merchandising that reinforces belief and desire on the site. If offers are not converting, it often means you expect the offer to do a job it was not built to do. Let the offer earn the email, then let the emails earn belief. Keep the door open with consistent follow-up so that when the moment is right, the purchase is easy. The resume gets you in the door; the interview gets the job. ! IYKYK

The Rule of 7 does not mean what you think it does.

#

If your open rate is 14%, it is not 7 emails. It is 49.

You have heard it before: it takes 7 touches to make a sale. Those touches are opens, not sends, and the difference is massive. If your open rate is 14%, you do not need 7 emails; you need 49, because 7 divided by 0.14 is 49. Read more

You have heard it before: it takes 7 touches to make a sale. Those touches are opens, not sends, and the difference is massive. If your open rate is 14%, you do not need 7 emails; you need 49, because 7 divided by 0.14 is 49. This reframes progress. If you have sent 14, 21, or 35 emails without results, you may be halfway, not failing. Many merchants quit at the moment they should double down, assuming the audience is uninterested when the sequence simply needs more opens. Campaigns usually fail because follow-up stops too soon, not because the offer is weak. Keep sending, keep building trust, and keep earning attention. When the seventh open finally happens, you will be the one they remember. ! IYKYK

You have got 7 seconds.

#

Trust and appeal decide what happens next.

Most visitors are not your buyer, and that is fine, but every visitor judges fast. First, do I trust this store. Second, can I see why these products might appeal to someone, even if not me. If either answer is no, they are gone and they will not open your next email. Read more

Most visitors are not your buyer, and that is fine, but every visitor judges fast. First, do I trust this store. Second, can I see why these products might appeal to someone, even if not me. If either answer is no, they are gone and they will not open your next email. You do not need instant conversion; you need instant belief. Belief earns curiosity, and curiosity keeps the door open. A hiking stick does not have to sell a non-hiker; it only has to spark the thought that it would be perfect for someone they know. Nail the first impression and every follow-up gets easier. Miss it and you are cold again. Make them trust you and believe that someone will care within those first 7 seconds. ! IYKYK

The customer drop-off you are worried about is not the one that is killing you.

#

Monitor churn at the bottom. Fix losses at the top. That

is where the

leverage is.

Many teams obsess over post-purchase churn, but the bigger leak happens before the first order. Acquisition fails when junk opt-ins cannot be reached, promotion fails when messages are off-time or off-message, and merchandising fails when the site does not help a visitor choose with confidence. Read more

Many teams obsess over post-purchase churn, but the bigger leak happens before the first order. Acquisition fails when junk opt-ins cannot be reached, promotion fails when messages are off-time or off-message, and merchandising fails when the site does not help a visitor choose with confidence. This pre-order drop-off quietly kills growth. With 50,000 impressions, 5,000 opted-in contacts, 1,000 orders, and a 2.5% repurchase rate, a 10% lift that flows through to first orders adds around 100 new orders, while a 10% lift in repurchases only adds a few. If they never buy once, there is nothing to grow. Do not skip straight to Grow. Earn Grow by passing the first test: turn a curious visitor into a real customer, then improve repurchase once the base is healthy. ! IYKYK

Trust first, returns second or risk failing quietly without sales.

#

Big brands obsess over returns. Small stores win by

building trust first.

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Read more

Many small Shopify merchants chase return reductions from day one and then wonder why sales never take off. Trust is what gets shoppers to say yes; returns are something you tune after orders are flowing. Without trust, no policy tweak converts a hesitant visitor. Trust lifts opens, clicks, and buys across every step, and returns only matter after you have won the sale. Virtually no small store fails from high returns; they fail from low sales amplified by low trust. Lead with trust and make the return promise short, plain, and visible everywhere. Use one line such as "Free 30-day returns," put it on the first screen of emails and above the fold on pages, and repeat it in cart and checkout. Do not hide it, complicate it, or bury it for creative space. Check it before every campaign and recheck monthly. Nail visibility on returns to earn the first yeses, grow sales, and then tune details later. ! IYKYK

Why the vendor's advice does not seem to work for my store.

#

Your vendors want you to win, but big-merchant gravity

shapes their

playbooks.

This is not about bad actors. Most vendors want you to succeed and care about your results. The issue is gravity that pulls inputs from the largest customers and projects them as general guidance. Read more

This is not about bad actors. Most vendors want you to succeed and care about your results. The issue is gravity that pulls inputs from the largest customers and projects them as general guidance. Market research interviews the biggest accounts, product research prioritizes their requests, case studies showcase eye-catching logos and numbers, and benchmarks are drawn from high-traffic stores. None of that is malicious; it is simply where the data and ROI live, but it creates a mismatch for smaller stores. When lessons are extracted from large-merchant inputs, the guidance is often off, wrong, or even inverted for most merchants. The fix is to use guidance built for your category, size, and maturity, and to be comfortable replacing vendor conventional wisdom when it does not fit. This does not mean the vendors are wrong. It means their insights may not apply to your inputs, constraints, or outcomes. ! IYKYK

You are not doing it wrong. You are just not a rocket ship ... yet.

#

Most expert advice is built on exceptions, not the

average.

If expert advice has not worked for your store, you are not alone. You are likely not doing it wrong. Podcasts, blogs, and conferences reward dramatic stories, and good stories lean on turning points, exceptional outcomes, and simple takeaways. Read more

If expert advice has not worked for your store, you are not alone. You are likely not doing it wrong. Podcasts, blogs, and conferences reward dramatic stories, and good stories lean on turning points, exceptional outcomes, and simple takeaways. That is the trap. They treat the exception as the average and present it as a roadmap. Your store is probably not a rocket ship, and most stores are not. Most merchants are grinding, earning every visitor, every open, and every dollar. When those tips do not work, it is usually because the strategy assumes magic inputs you do not have. Focus on the boring basics that compound: sustainable cadence, predictable improvement, and discouragement-free execution. That is what builds real progress when you are not the exception. ! IYKYK

It is not you, it is them.#

Most popular Shopify apps are not built for your scale, so

they focus you

on the wrong things.

If you tried popular Shopify apps and felt let down, here is the truth: most were not designed for merchants like you. A low-priced tier is often a de-featured version of an enterprise product, not a tool built around small-merchant constraints. Read more

If you tried popular Shopify apps and felt let down, here is the truth: most were not designed for merchants like you. A low-priced tier is often a de-featured version of an enterprise product, not a tool built around small-merchant constraints. Enterprise gravity creates three traps: features that miss your real problems, roadmaps aimed at big-brand priorities, and benchmarks that assume high traffic and make healthy small-store numbers look broken. You end up pushing buttons without getting outcomes. If the promised results are not showing up, or doing more inside the tool does not move the needle, switch to software designed for your inputs from the start: your traffic, your list size, and your time budget. ! IYKYK

One size does not fit your store. Build what does.

#

Some merchants have unique challenges and unique ideas.

Off-the-shelf

tools do not always solve them.

Most apps are built for the median merchant. If your store has unusual catalog rules, bundling, pricing, fulfillment, or buyer behavior, the one-size approach caps your outcome. Read more

Most apps are built for the median merchant. If your store has unusual catalog rules, bundling, pricing, fulfillment, or buyer behavior, the one-size approach caps your outcome. Tokuhn builds focused Shopify apps to solve the specific thing holding you back. We align to your funnel work: Acquire, Sell, Grow, Thrive, and implement only what moves your metrics. Examples include verified email capture without gimmicks, price-guarantee logic, coalition points and offers, POS line-item actions, store-branded protection, or a feature that exists only in your head today. The result is an edge your competitors cannot download, with data and workflow that match how you operate. One size does not always fit all. When you have a unique challenge or a unique insight, build what is yours. Insights in the spotlight

Top Spending Traps for Shopify MerchantsTL;DR: Stop Bleeding Cash on What Doesn't WorkShopify merchants often invest in growth strategies that seem promising but fail to generate a return. The real threats to profitability aren't always obvious, they come disguised as conventional wisdom. Instead of repeating costly mistakes, merchants should focus on strategies that deliver real revenue and avoid the biggest money pits. This white paper breaks down 13 of the worst money losers Shopify merchants fall into, why they don't work, and what alternatives actually drive sales and profit.

1. Paid Advertising (As Your Only Outbaond Channel)

Many Shopify merchants invest in paid advertising, believing it to be the quickest way to generate sales. However, platforms like Facebook, Instagram, and Google Ads have become increasingly competitive, making it difficult for smaller merchants to see a positive return on investment. The rising cost of ads, combined with high customer acquisition costs (CAC), often means that merchants spend more acquiring customers than they earn from their first purchase. Furthermore, ad algorithms favor larger brands with bigger budgets, putting smaller merchants at a disadvantage. Rather than pouring money into paid ads from the start, merchants should prioritize organic traffic through SEO, content marketing, and building an engaged community. Referral programs and influencer partnerships that reward performance can also provide a more cost-effective way to attract customers. Sources: Neil Patel 2. SaaS Subscriptions (Expensive Apps with Minimal Impact)

With thousands of apps available in the Shopify ecosystem, merchants often fall into the trap of installing multiple tools that promise to boost sales or streamline operations. However, many apps come with high monthly subscription costs and provide only marginal benefits. Additionally, overlapping functionalities between different apps can lead to unnecessary expenses and even slow down a store's performance, negatively affecting conversions. To avoid excessive software costs, merchants should regularly review their app subscriptions and remove any that do not directly contribute to revenue growth. Using Shopify's built-in features whenever possible and opting for apps that charge based on performance rather than flat fees can help minimize wasteful spending. Sources: Firebear Studio 3. Influencer Marketing (Without Data-Driven Selection)

Many Shopify merchants turn to influencer marketing, hoping that partnering with social media personalities will drive significant traffic and sales. However, simply paying influencers without analyzing their audience demographics or engagement quality can lead to wasted marketing budgets. Influencer fraud, where creators inflate follower counts or engagement metrics, is a common issue that results in brands paying for exposure that generates little to no revenue. Instead of selecting influencers based solely on their follower count, merchants should focus on micro-influencers who have highly engaged audiences within their niche. Providing influencers with unique tracking links or discount codes can help measure actual sales impact, ensuring that influencer partnerships deliver tangible results. How Companies Like Grin Can Help: Platforms like Grin provide merchants with tools to streamline influencer marketing and maximize ROI. These platforms help merchants:

By leveraging platforms like Grin, Shopify merchants can make informed decisions, avoid influencer fraud, and create partnerships that drive real revenue. Sources: Insense.pro 4. Custom Website Development (Overbuilding Before Validating)

One of the biggest money sinks for Shopify merchants is overinvesting in custom website development before validating their product or market demand. Many entrepreneurs believe that a fully custom-designed store with advanced features will automatically lead to higher sales. However, this assumption often leads to wasted resources. A beautifully designed site does not guarantee conversions if there is no proven customer interest. Instead, merchants should take a lean approach. Starting with a simple Shopify theme and minimal customizations allows them to validate demand without excessive costs. By focusing on core functionality and making iterative improvements based on real customer feedback, they ensure that resources are allocated effectively. Investing in website enhancements should come after establishing a steady flow of sales. Sources: The Dallas Company 5. SEO & Marketing Agencies That Don't Guarantee Performance

Many Shopify merchants turn to SEO and marketing agencies, expecting them to drive traffic and increase conversions. However, agencies that charge high retainers without guaranteeing measurable results can become a financial drain. Some firms prioritize vanity metrics such as website traffic or keyword rankings rather than focusing on real sales impact. To ensure that marketing investments lead to meaningful outcomes, merchants should seek agencies that offer performance-based pricing or trial projects. Additionally, developing in-house SEO knowledge and using AI-powered marketing tools can help businesses retain control over their strategies and reduce dependence on expensive agencies. Sources: Sebo Marketing 6. Over-Stocking Inventory (Without Sales Validation)

Merchants often make the mistake of purchasing large quantities of inventory before validating demand. While bulk buying may seem like a cost-saving strategy, it can lead to significant cash flow problems when products don't sell as expected. Excess inventory takes up valuable storage space and may require heavy discounting to clear, further reducing profitability. Instead, merchants should use data-driven inventory management techniques. Starting with small order quantities, dropshipping, or pre-orders allows them to gauge interest before committing to large purchases. Implementing just-in-time inventory practices and monitoring sales trends ensures that inventory levels align with actual customer demand. Sources: Shopify Blog 7. Premium Shipping & Fulfillment Costs (That Don't Increase Conversions)

Many Shopify merchants assume that offering ultra-fast shipping or premium fulfillment options will drastically improve their conversion rates. However, research shows that customers prioritize affordability over speed in most cases. While next-day or two-day shipping might seem appealing, these premium shipping options can significantly increase costs without providing a proportional boost in sales. Instead of defaulting to expensive fulfillment solutions, merchants should focus on optimizing standard shipping options. Studies have shown that free shipping incentives, rather than speed, are more likely to drive conversions. Setting a free shipping threshold, such as offering free shipping on orders over a certain amount, can encourage larger cart sizes while keeping fulfillment costs under control. Sources: Retail Dive 8. Fancy Packaging & Unnecessary Branding Costs

Investing in elaborate packaging, custom boxes, or excessive branded materials might seem like a way to enhance the customer experience, but it often results in unnecessary costs with little return. While a well-designed unboxing experience can be engaging, the majority of customers prioritize product value and pricing over packaging aesthetics. Over time, these branding expenses add up and reduce overall profit margins. Instead of splurging on high-end packaging, merchants should take a balanced approach by using simple, cost-effective packaging that protects the product while maintaining brand consistency. A thoughtful touch, such as a handwritten thank-you note or an eco-friendly package, can create a memorable customer experience without excessive costs. The goal should be to invest in elements that encourage repeat purchases rather than one-time aesthetic appeals. Sources: Kenco Group 9. Hiring PR Firms (Without a Clear Strategy)

Hiring a public relations firm might seem like a smart investment for generating brand awareness, but without a clear strategy, it can quickly turn into a costly mistake. Many merchants assume that PR agencies will automatically secure press coverage that leads to sales, but this is not always the case. If a business lacks a compelling story or newsworthy angle, PR efforts may result in expensive media placements that do not translate into customer engagement or revenue. Before committing to a PR firm, merchants should first refine their brand messaging and identify what makes their product or story unique. Testing out DIY PR tactics, such as reaching out to niche bloggers or leveraging customer success stories, can help gauge the potential effectiveness of PR efforts. If hiring a firm, merchants should set clear performance expectations, such as securing a specific number of media placements or tracking traffic from PR campaigns. Sources: Reddit 10. Paid Directories & Marketplace Listings

Many Shopify merchants believe that paying for premium directory listings or marketplace placements will significantly boost their visibility and sales. However, many paid directories lack real customer traffic and provide little return on investment. Some even charge hefty fees while offering minimal exposure, leading to wasted marketing budgets. Instead of relying on paid directory listings, merchants should focus on high-impact, organic strategies such as improving their store's SEO, leveraging customer reviews, and listing on marketplaces that have proven customer volume. Before investing in a directory, merchants should check whether it ranks on the first page of search results for relevant keywords. If a directory does not appear organically, chances are it won't drive meaningful traffic. Sources: Moz 11. General "E-Commerce Coaches" Without Proven Shopify Success

With the rise of online business coaching, many so-called "e-commerce experts" sell courses and mentorship programs promising overnight success. However, a significant number of these coaches have never actually built a successful Shopify store themselves. Their advice is often generic, outdated, or ineffective, leading merchants to waste money on guidance that doesn't translate into real-world results. Merchants should be highly selective when choosing mentors. They should seek out coaches who can provide verified case studies, references, or direct examples of Shopify stores they have successfully grown. Alternatively, Shopify's own educational resources, forums, and expert-vetted consultants are often more reliable and cost-effective sources of guidance. Sources: FTC 12. Conversion Rate Optimization (CRO) "Experts" Without Data-Driven Testing